Going For Gold: How the Golden Share Model Protects Mission and Independence

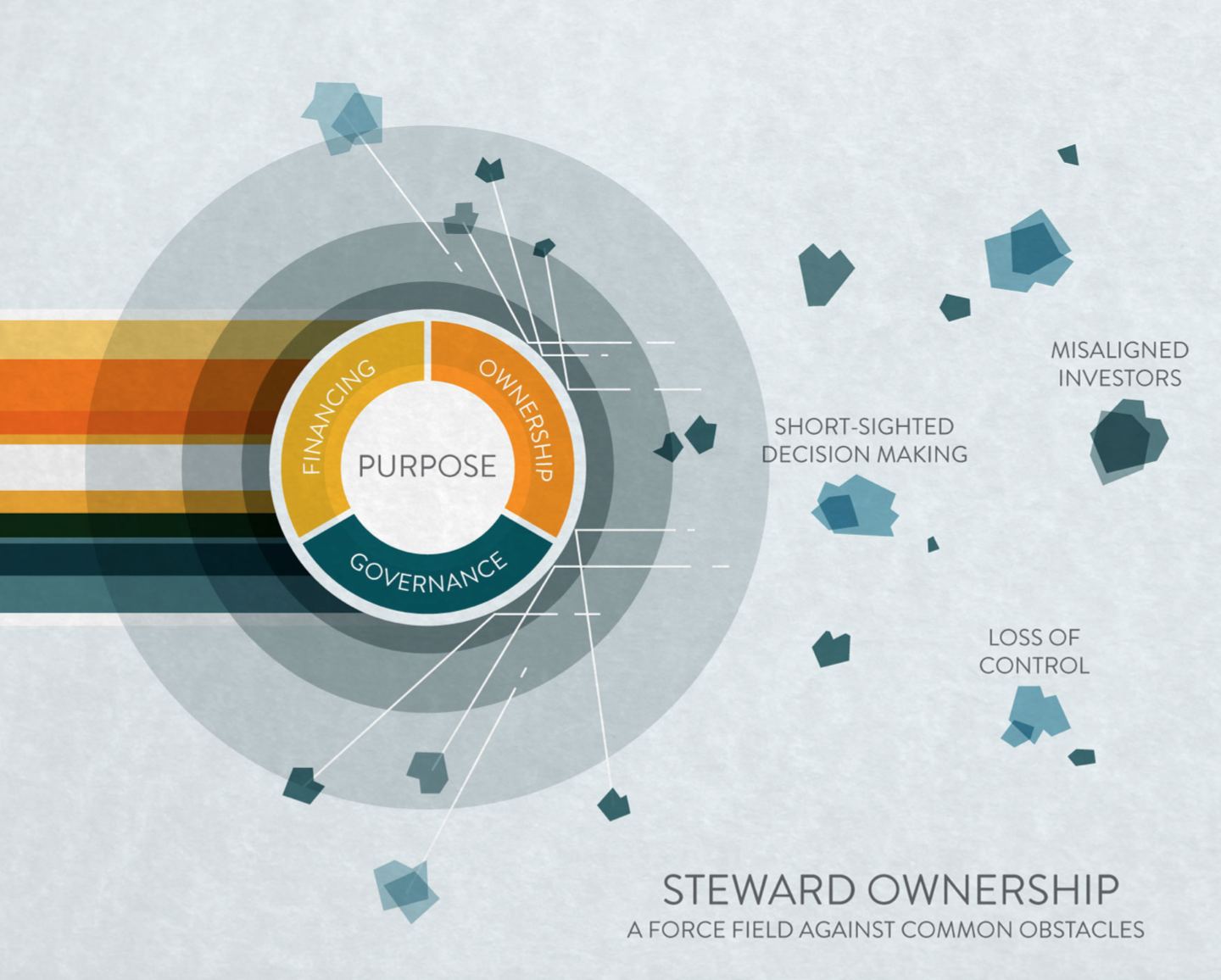

The Golden Share model is a form of steward ownership and is generally considered to be one of the least expensive and simplest models to set-up and administer.

In a nutshell, to establish a Golden Share model you take an existing for-profit corporation (C corporation or LLC in the US) and divide the economic and voting rights through the use of different shareholder classes. In addition to divvying up the economic and voting shares, at least one percent of the voting shares are classified as “golden shares” which have the rights to a) veto the sale of the company and/or b) veto changes to the structure in a manner which would undermine its commitments to purpose (thus they are sometimes also referred to as “veto shares”).

There is a great deal of flexibility in how the economic and voting share classes are assigned and allocated in a Golden Share model. The basic mechanics are that voting shares, sometimes called “steward shares” are held by people or entities that are committed to protecting and furthering the company’s purpose, and economic shares can be held by a variety of stakeholders who can share in the financial success and growth of the company but who do not have the right to steer the company. In this way, the mission and independence of the company is protected, similar to a purpose trust, but ownership is kept within the company rather than being held by an outside entity.

Let’s walk through the three different types of shares:

1. Voting / Steward Shares

Voting shares cannot be sold or inherited, instead they are passed to “merit-based” successors who have demonstrated ability and alignment with the company’s purpose. Companies are free to determine the qualifications required to hold voting shares – in some companies they may be held broadly by active employees, in others there may be an elected or appointed board that includes selected leaders.

2. Economic Shares

Economic shares can be designed in a variety of ways to best match the company’s capitalization and cash flow needs. For example, holders of these shares may be entitled to an ongoing variable annual dividend based on company performance, or there may be an agreement to use a certain portion of the company’s free cash flows to buy-back the shares at some predetermined value (for example 1x to 3x the original share value).

Economic shares can be held by a variety of stakeholders including investors, founders, employees and/or charitable organizations. Multiple classes of economic shares can be issued with different types of economic rights (e.g. founder-employee shares vs investor shares).

3. Golden / Veto Share

Most companies choose to have an independent or third-party nonprofit hold the veto share to ensure that an uninterested party will be responsible for rejecting any attempted sale or changes to purpose.

Ziel Activewear is a real-world example of a Golden Share model. 99% of the common stock is held in Steward Shares that have voting rights but no economic rights; these shares can only be held by people closely related to the company’s operations or mission. Founder Shares were issued via non-voting redeemable preferred stock, with economic rights so they may receive dividends. A separate class of stock (non-voting redeemable preferred) was issued for investors, who also receive dividends. The final 1% of common stock – the Golden Share – is held by Purpose Foundation, who holds the right to veto the sale of the company and/or any changes to the structure that would undermine its purpose.

Pros

Golden Share models offer founders of companies a high degree of flexibility in determining how to design/allocate voting and economic shares to best serve the mission and match the capitalization needs of the business using a basic corporate form. Because the models are relatively inexpensive to implement and simple to administer, they are often attractive to start-up entrepreneurs.

Cons

Founders in the fundraising stage may find it difficult to attract investors who are willing to take a complete separation from governance rights. In addition, start-ups may find it challenging to anticipate which candidates will be best-suited to directly hold voting shares if the company is going through rapid growth and forming new relationships. Additionally, companies must ensure that they avoid creating the potential for conflicts of interest between profit-maximization and mission-preservation in how the different classes of shares are allocated (conflicts could occur if founders /employees are assigned both Class A voting shares and Class B un-capped economic shares).

Interested in learning more? Let’s talk.